In 2025, Intel’s Foundry services have been struggling to gain momentum in the market. Despite the company’s efforts, their revenue remains significantly lower than TSMC’s, making a break-even scenario seem distant.

Challenges Ahead for Intel’s Foundry Division

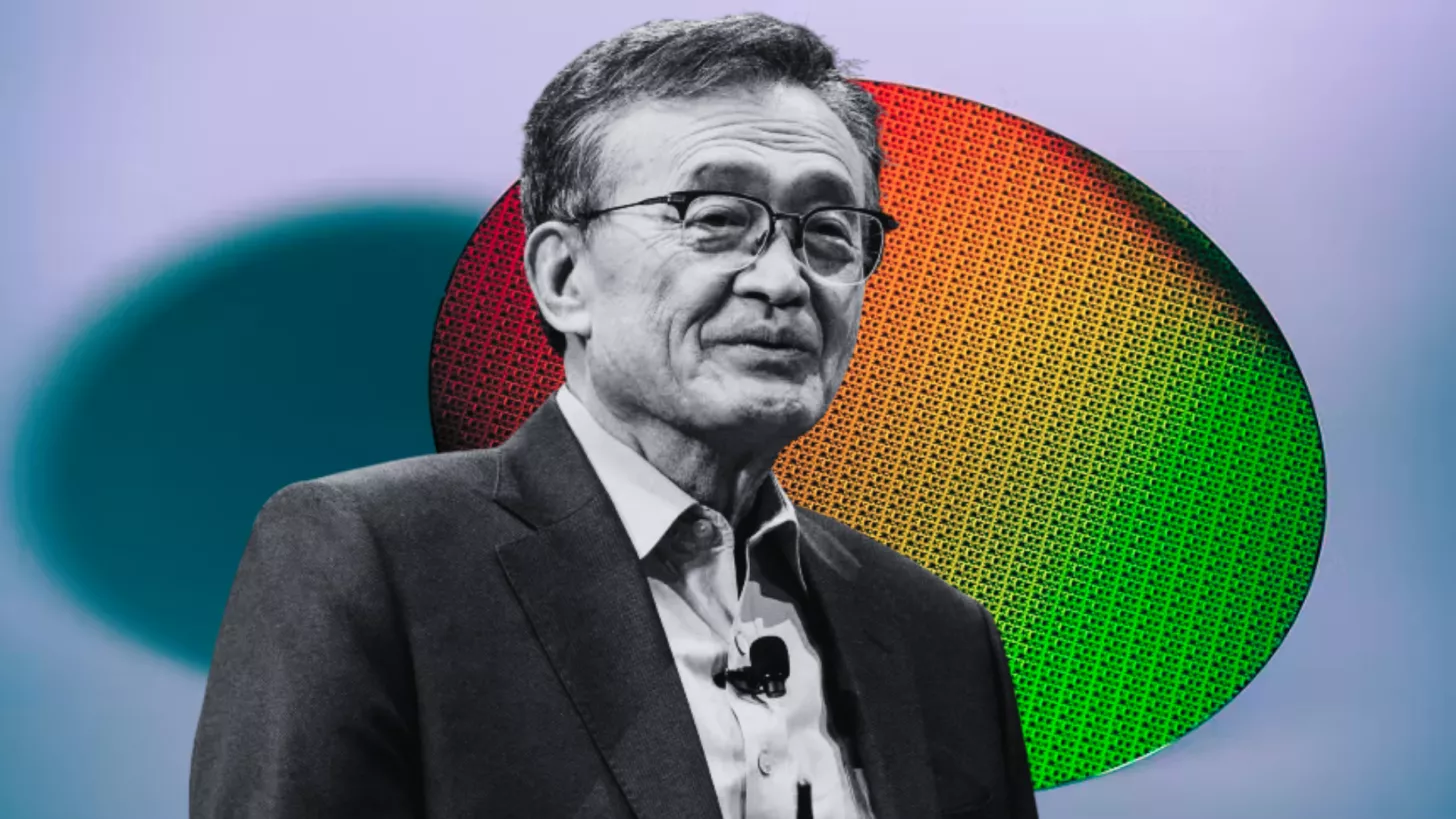

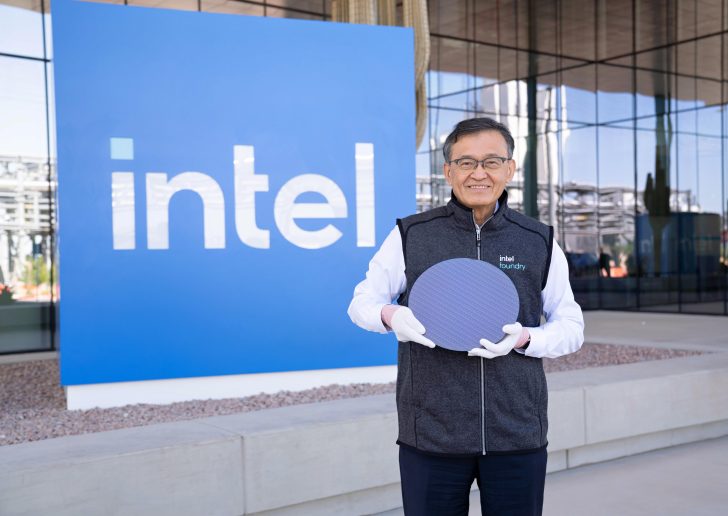

Since CEO Lip-Bu Tan took the helm, Intel has undergone substantial changes across various sectors, including consumer products and AI. However, the foundry division, in particular, has a long journey ahead. Reports suggest Intel’s foundry revenue is a staggering 1000 times less than TSMC’s. This year, Intel’s Foundry revenue is projected at $120 million, a stark contrast to the expenditure on processes like the 18A. Despite this, there is a glimmer of hope as industry giants like Tesla, Broadcom, and Microsoft show interest in Intel’s 18A and 14A processes, offering potential for a significant turnaround.

Prospects for Future Growth

While Intel’s Foundry faces financial hurdles, the interest from major corporations indicates that their chip services could eventually compete with TSMC. The upcoming processes, like the 18A and 14A, are crucial for Intel’s revival in the market. Despite recent successes with their 18A node, Intel must continue to innovate to stay relevant in the competitive chip industry. CEO Lip-Bu Tan has emphasized that external customer interest is vital for the survival of Intel’s advanced chip technologies.

Facing Industry Giants

The disparity between Intel’s Foundry and TSMC highlights the challenges of catching up in the chip manufacturing race. As industry leaders like TSMC continue to dominate, Intel must accelerate its efforts to regain its position. The future of Intel’s involvement in the cutting-edge chip race will depend heavily on their ability to attract external clients and deliver innovative technologies.