The landscape of memory pricing is on the brink of a significant shift, with DDR5 and DDR4 memory costs anticipated to rise sharply. This change is driven by the ‘DRAM supercycle’, which has been heavily influenced by the burgeoning demand from AI technologies. As AI continues to consume available DRAM capacity, consumers are likely to see these increased costs reflected in their purchases.

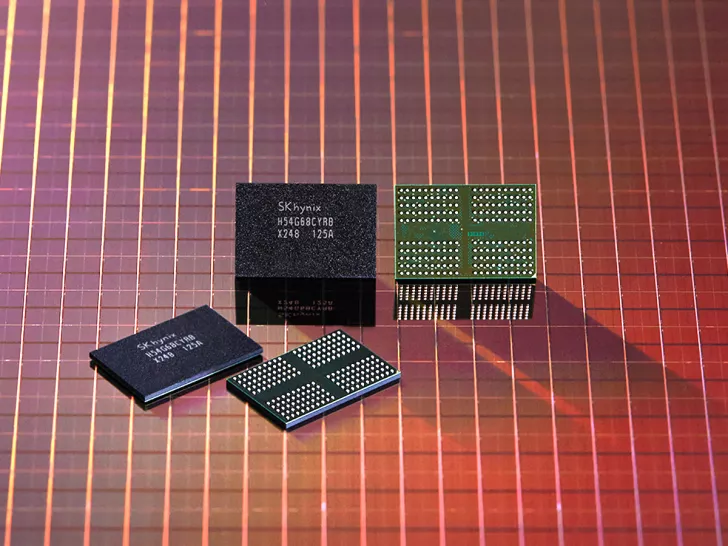

30% Price Increase Expected from Major DRAM Suppliers

The rapid evolution of the DRAM market has been attributed to its vital role in supporting AI workloads through high-bandwidth memory (HBM). Companies like Micron are shifting production towards DRAM to meet this growing demand. Recent reports highlight that major DRAM manufacturers, including Samsung and SK hynix, are planning for a 30% price increase in DRAM and NAND flash chips, potentially affecting consumer prices by Q4. This spike in demand is largely attributed to AI advancements, with firms like NVIDIA and AMD increasing their HBM requirements, and custom AI chips from tech giants further driving up demand.

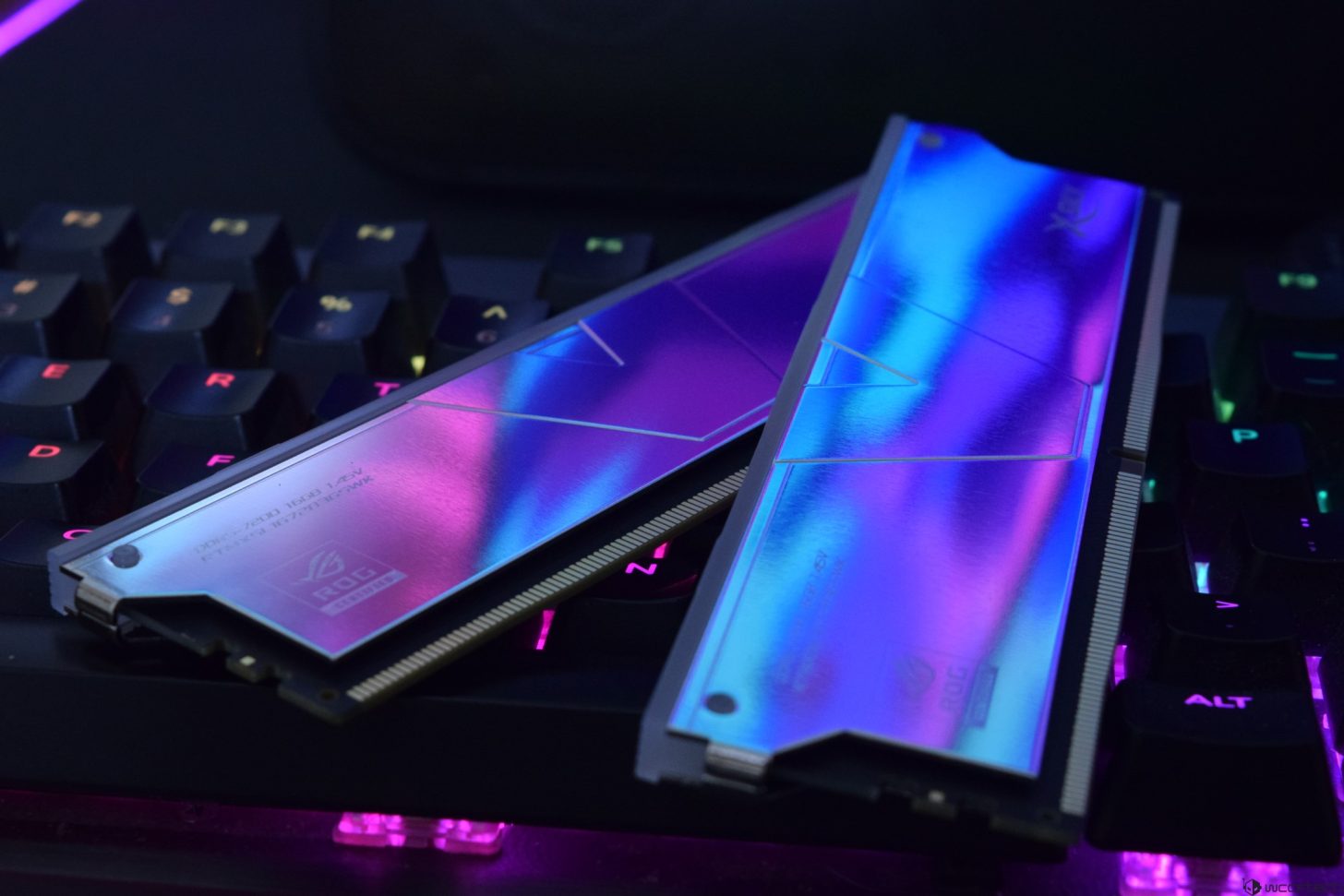

Rising Price Trends for DDR4 and DDR5 Modules

Price trends for DDR4 and DDR5 memory modules have been climbing for several weeks. Sources indicate a recent 5% increase in the price of DDR5 16 GB. Retailers like Amazon and Newegg have similarly adjusted their pricing, with models such as the G.Skill Trident Z5 Neo experiencing a significant 40% price surge, reaching €189.90 on Idealo.de. This trend is expected to persist into subsequent quarters.

Consumer Market Reactions and Future Outlook

While current RAM prices might not seem excessively high, the anticipated price adjustments by major producers suggest that consumers could soon feel the pinch. As companies like Micron, Samsung, and SK hynix predict price hikes, those considering a memory upgrade may find Q3 to be their last affordable opportunity. Looking forward, Q4 2025 and beyond are projected to be costly times for consumer RAM purchases.