DDR5 Memory Prices for Laptop DIY Edition Soar by 50%

Framework has announced a significant price adjustment for its DDR5 memory, marking a 50% increase in costs for their DIY Laptop Edition. This move comes as the company grapples with a challenging supply landscape that has led to widespread impacts across the tech industry.

DDR5 Price Surge Hits Framework Laptops

In a recent update, Framework revealed plans to raise DDR5 memory prices, citing escalating supply issues affecting the entire market. With current DDR5 costs already soaring to three or four times their previous levels, it’s anticipated that many system integrators will follow suit in adjusting their pricing structures.

According to Framework, the new pricing aims to offset the substantial increase in costs from suppliers, although they maintain that their prices remain below current market rates.

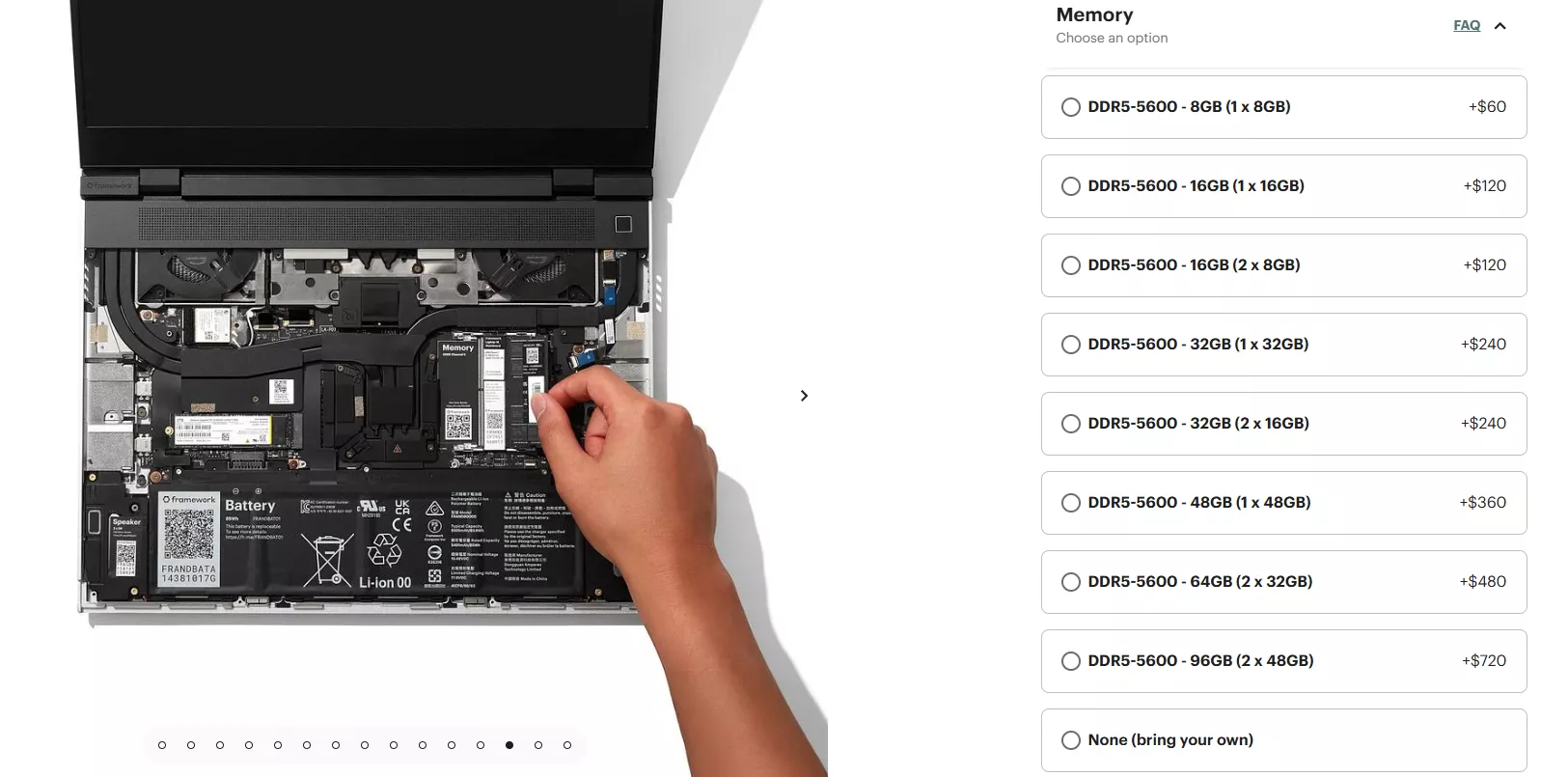

Today, we increased our pricing on the DDR5 memory configurable in Framework Laptop DIY Edition orders by 50% to begin to respond to the substantially higher costs we are facing from suppliers and distributors. The new pricing remains below what is available in the open market.

– Framework

Impact on Pre-orders and Future Adjustments

Framework assures that customers with existing pre-orders will not be affected by this change. However, there is a strong possibility of further price adjustments in the future, particularly for products using DDR5, LPDDR5X, or GDDR memory. The company has emphasized that the DIY desktop edition will remain unaffected for now, yet hints suggest potential changes could occur down the line. At present, the Ryzen AI 300-powered DIY desktop is available with up to 128 GB of LPDDR5X memory, priced at $1,999.

We aren’t changing pricing on any existing pre-orders, and we also are not yet updating pricing on our pre-built laptops or Framework Desktop which come with memory…

– Framework

Future Market Outlook

Framework remains committed to keeping consumers informed about any future price changes and plans to lower prices when the market stabilizes. The company is striving to absorb some of the costs to maintain pricing stability, though it acknowledges that a return to normalcy in the memory market is unlikely before 2026. The departure of key industry player Micron from the consumer market has further complicated efforts to meet demand.