Intel is setting the stage for its 14A node to focus primarily on meeting the needs of external customers. This strategic shift is expected to significantly impact the company’s financial landscape, potentially increasing foundry expenses. As Intel charts this new course, it is poised to elevate its presence in the global semiconductor market.

Intel’s Strategic Shift Towards the 14A Node

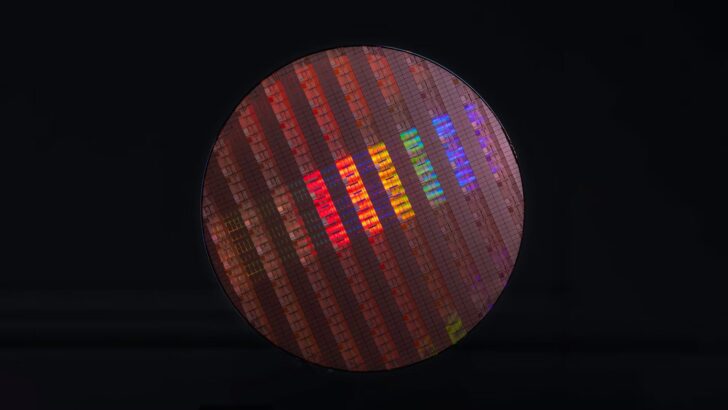

Over recent months, Intel Foundry has drawn considerable attention due to developments in America’s chip supply chain. Known for producing the ‘world’s most advanced’ node, the 18A, Intel is now turning its gaze towards the 14A process. John Pitzer, Intel’s Vice President, highlighted the company’s confidence in this new venture during his talk at the 2025 RBC Capital Markets conference. The move towards external customer focus is expected to drive up expenses, a point Pitzer openly discussed.

When we win a customer for Intel 14A, we will have to layer on expenses well ahead of getting revenue. I do think, you know, for transparency purposes, as 14A sort of customer traction materializes, it’s likely to push out that [breakeven] end of 2027. I’m thinking, though, most investors will be okay with that because it will be confirmation that we can actually stand up an external foundry.

Preparing for External Demand

Intel is gearing up for the 14A to meet external demands, distinguishing it from the 18A, which is reserved for products like Panther Lake and Clearwater Forrest. Reports suggest there is a high level of customer interest in the 14A process based on PDK sampling. This indicates that for Intel to meet external demand, the IFS will need to significantly increase production capacity, which will entail higher spending.

Investor Confidence Amid Financial Adjustments

Intel plans to exercise caution with the 14A node by scaling capital expenditures based on client interest and adhering to CEO Lip-Bu Tan’s ‘no blank check’ policy. The successful adoption of the 14A process could delay Intel’s foundry breakeven timeline to the end of 2027, but company officials remain optimistic, believing investors will support the strategy as it positions Intel alongside key industry players like TSMC and Samsung.