The dynamics of the consumer CPU market are shifting rapidly, with Intel’s share dwindling significantly. Recent sales figures underscore a troubling decline for Intel, with its revenue share plummeting below 5% last week. Meanwhile, AMD is solidifying its dominance, outpacing Intel with overwhelming numbers.

AMD’s Dominance in the CPU Market

Intel’s presence in the desktop segment appears increasingly precarious as AMD continues to capture the market. Sales statistics from prominent retailers like Mindfactory and Amazon highlight a stark contrast in consumer preference. Despite Intel’s attempts to compete, AMD’s older AM4 platform remains a strong contender, overshadowing Intel’s offerings.

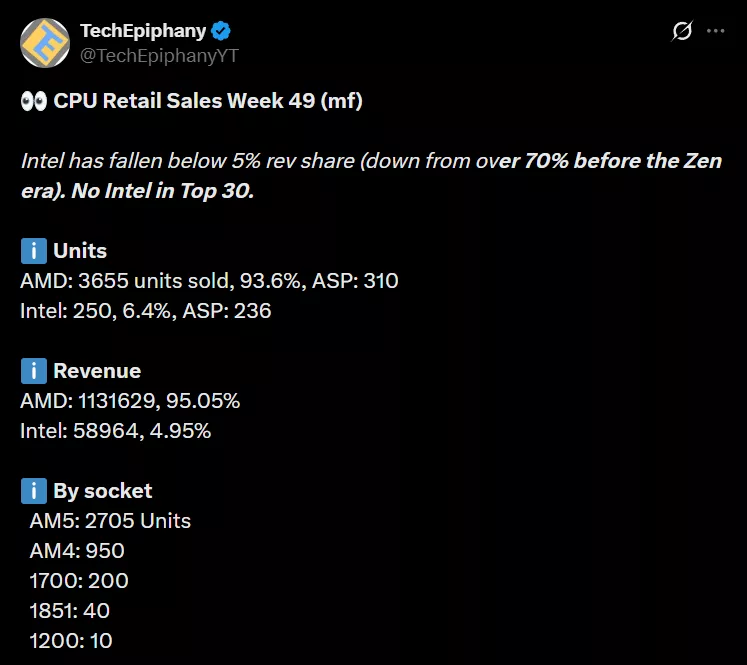

Approximately two weeks ago, sources revealed that AMD’s growth in the desktop CPU market was accelerating, particularly in Germany. The situation worsened for Intel last week, with its revenue share dropping from over 7% to under 5%. This marks a significant low, and if trends persist, Intel’s share may diminish further.

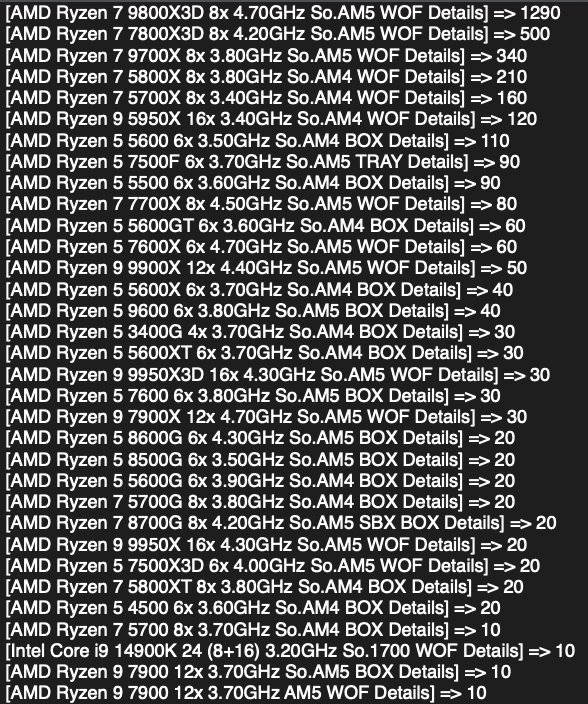

Recent sales data from Mindfactory indicated that nearly 3,655 units of AMD CPUs were sold, contrasting sharply with Intel’s meager 250 units for the same period. Among Intel’s sales, only 40 units were from the latest Arrow Lake series, while the remaining 200 units comprised older models. The Ryzen 7 9800X3D continues to lead, followed by other Ryzen models.

Market Share and Future Outlook

AMD’s commanding market share stands at 93.6% (95.05% Revenue) with an average selling price of 310 Euros. Intel trails significantly with a mere 6.4% (4.95% Revenue), despite a lower average selling price of 236 Euros. The lack of competitive Intel chips against AMD’s high-performance models contributes to this disparity. The rising cost of Intel’s 14th-gen CPUs might also be a factor in their declining sales.

This trend isn’t unique to Mindfactory. Reports suggest that AMD’s Ryzen 7 9800X3D and 7800X3D have outsold the entire Intel CPU lineup even on platforms like Amazon US. As Intel’s Nova Lake series remains distant from launch, the company risks losing further ground in a segment that was once its forte.