The AI industry is witnessing a significant shift, and NVIDIA is at the forefront, securing a substantial portion of advanced packaging resources. As the demand for AI solutions grows, so does the importance of efficient packaging technologies, which are becoming a critical bottleneck in the industry.

NVIDIA’s Strategic Move in CoWoS Capacity

Reports suggest that NVIDIA is set to dominate the CoWoS capacity, claiming more than half of TSMC’s resources by 2026. This move aligns with their plans for the Blackwell Ultra ramp-up and preparation for the Rubin architecture. Sources indicate that NVIDIA has reserved between 800,000 to 850,000 wafers for 2026, overshadowing allocations to other players like Broadcom and AMD.

Despite outsourcing efforts, TSMC is expected to maintain a significant share of CoWoS capacity. Following NVIDIA, Broadcom, and AMD, TSMC is projected to be the largest customer for advanced packaging. However, the current orders do not account for potential demand from China, especially for NVIDIA’s H200 AI chips. This increased demand could lead to higher capacity allocation requirements, posing significant challenges for both TSMC and its competitors.

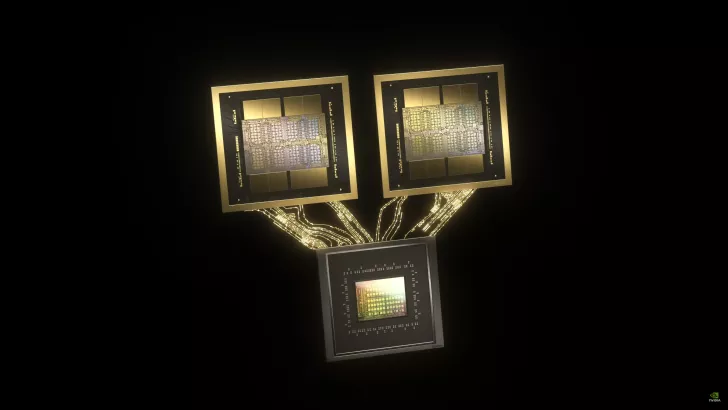

TSMC’s Expansion and Industry Trends

TSMC is actively expanding its advanced packaging capabilities, with significant developments at its Chiayi AP7 plant and plans for new facilities in Arizona. Although mass production in the US is expected by 2028, supply constraints are anticipated to persist. As the industry pivots towards inference-focused AI solutions, ASICs, and technologies like Google’s TPUs are gaining ground, yet large-scale production for widespread use remains a hurdle.