Samsung’s HBM business is on a strong upward trajectory compared to its position a few quarters ago. The company’s HBM4 technology is poised to become the most powerful solution available in the market, signaling a significant improvement in Samsung’s prospects.

Rapid Growth in Samsung’s HBM Market Share

Despite uncertainties in its DRAM business over the years, Samsung has maintained dominance among its competitors for decades. However, the rise in demand for HBM saw the company face challenges, particularly with HBM3, as it initially struggled to secure certification from major clients like AMD and NVIDIA due to yield and thermal issues. Following a strategic internal shift, Samsung is now back on the growth path.

In a New Year’s address, Samsung’s co-CEO and chip chief, Jun Young-hyun, expressed optimism about the company’s prospects in the HBM4 sector, particularly with AI industry demand. The company’s lead in HBM4 is attributed to its early start in 1c DRAM development and strategic collaborations with partners such as NVIDIA.

“On HBM4 in particular, customers have even stated that ‘Samsung is back’,” Jun said in remarks reviewed by Reuters, adding that the company still had work to do to further improve competitiveness.

– Reuters

Securing a Competitive Edge

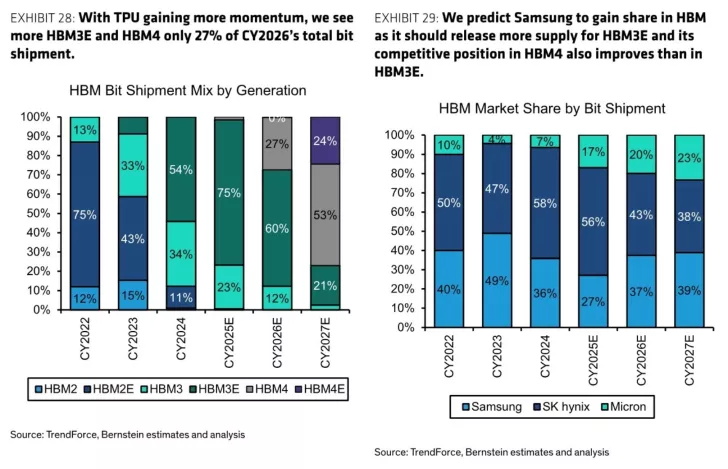

Samsung is recognized for its HBM4 modules, which boast the industry’s fastest pin speeds at 11 Gbps, attracting interest from major clients like NVIDIA. The company’s extensive DRAM supply chains and strategic pricing of HBM4 have given it a competitive advantage over its rivals. Reports suggest that by 2027, Samsung’s market share is expected to surpass that of SK hynix, according to Bernstein’s HBM modeling.

While DRAM demand continues to surge, it’s clear that all memory suppliers, including Micron, SK hynix, and Samsung, stand to benefit from the AI-driven order flow, setting up a promising future for these companies.