Samsung is gearing up for an exciting leap in memory technology as it prepares to launch mass production of next-gen memory products. The anticipation is building for a robust supply of 2nm GAA process, next-gen HBM4 memory, 24 Gb GDDR7 DRAM, and 128 GB+ products by 2026.

Exciting Earnings and a Glimpse of the Future

In its recently unveiled Q3 2025 earnings report, Samsung announced a notable 15.4% revenue increase from the previous quarter, reaching KRW 86.1 trillion. This impressive growth is largely attributed to a surge in demand for HBM3E memory and server SSDs, fueled by the accelerating momentum in AI technologies.

Samsung’s introduction of its next-gen HBM4 memory solution, capable of reaching speeds of up to 11 Gbps per IC, promises to be a game-changer for future AI accelerators from NVIDIA and AMD, such as Rubin and the MI400 series. Reports suggest samples of these HBM solutions have already been sent to AI chipmakers for further evaluation.

Strategic Plans for Revolutionary Technology

Samsung’s roadmap includes a stable supply of 2nm GAA production and the HBM4 base die slated for 2026. The 2nm process is expected to be integral for the next-gen Exynos SoC and Qualcomm Snapdragon SoCs, with production ramping up this quarter.

By 2026, Samsung aims to mass-produce HBM4 products with standout performance while expanding its sales base, addressing the projected increase in demand for HBM4 with strategic capacity growth. The company is also focusing on expanding its high-value memory product lineup, including DDR5, LPDDR5x, and QLC SSDs, catering to the growing needs of AI applications.

Meanwhile, the Foundry Business is set to enhance its operations, optimizing costs and increasing fab utilization as it ramps up mass production of 2nm GAA products. Samsung’s fab in Taylor, Texas, is anticipated to begin operations timely, ensuring a stable supply of these innovative products.

Impact on Consumer Products and Market Dynamics

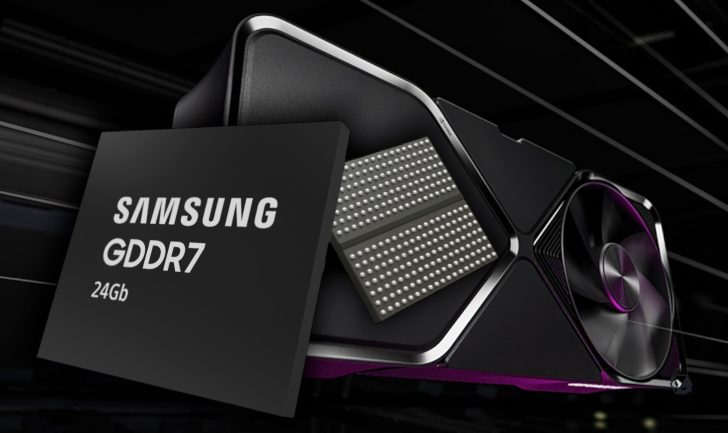

Samsung’s 128GB+ DDR5 memory and 24Gb GDDR7 DRAM are projected to be pivotal for the company in 2026, coinciding with new server platforms’ anticipated release from AMD and Intel in the latter half of the year. Enthusiasts and professionals alike are eager to see how these developments will unfold.

GDDR7 is expected to remain a favorite among high-end consumers and AI graphics cards. NVIDIA’s Rubin CPX GPU emerges as a promising candidate for this memory, alongside other anticipated products like the NVIDIA RTX 50 “SUPER” series and a potential AMD Radeon “RDNA 5” or “RDNA 4” refresh.

As the spotlight remains on AI markets, the DRAM and SSD sectors face challenges with supply constraints, causing consumer product prices to soar. Reports suggest that DDR5 and SSD prices are climbing due to these pressures, a trend that industry watchers are keenly monitoring as major DRAM manufacturers adjust their pricing strategies.