Samsung Prioritizes DDR5 Over HBM Amid Severe Memory Shortages for Maximum Profit

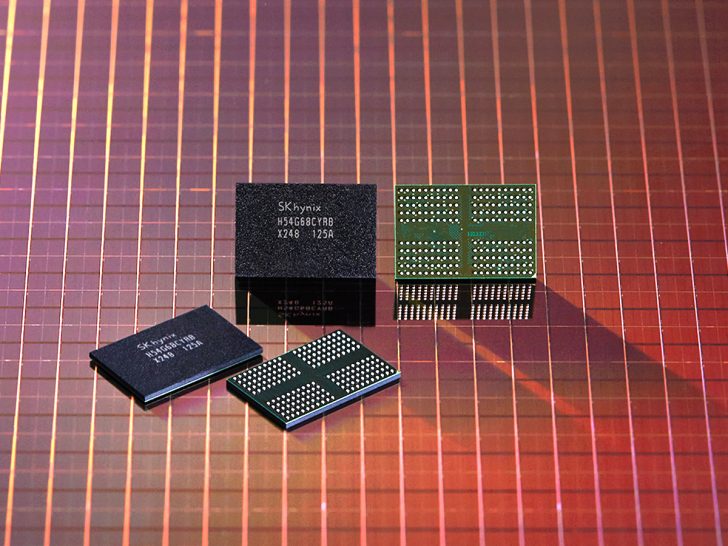

Samsung is on the verge of a significant transformation in its DRAM production strategy to align with the surging demand for DDR modules. This move aims to maximize profits amid the ongoing memory supercycle, a crucial period for the tech giant.

Samsung’s Strategy: Prioritizing DDR5 Over HBM for AI

Reports suggest that memory shortages have reached an unprecedented level, driving prices of some RAM modules beyond the $1,000 mark. As the supply remains tight, Samsung is reportedly shifting focus to DDR and LPDDR modules. The fierce competition in the HBM sector has impacted profitability, prompting Samsung to capitalize on the soaring DDR5 spot prices. This strategic decision provides a lucrative opportunity for the company.

The official price of a 64GB RDIMM has risen from about US$265 in the third quarter of 2025 to US$450 in the fourth, nearly a 70% jump. DDR5 is now contributing more profit to Samsung than HBM3E, and future quarterly price increases could push modules toward US$500.

Samsung plans to allocate more production capacity to 1c DRAM technology, which will expand the output of DDR5, LPDDR5X, LPDDR6, and GDDR7 modules. The company sees a substantial 75% gross margin with RDIMMs. This adjustment allows Samsung to gain more from general-purpose DRAM than from HBM. However, the consumer market might not benefit as much as expected, as most production is anticipated to serve the AI sector, particularly for CSPs and AI giants building data centers.

Implications for the Consumer Market and Industry Dynamics

This realignment of focus is reflective of recent industry trends, as highlighted by Micron’s decision to exit the consumer business. The demand driven by AI offers higher gross margins, which DRAM suppliers are keen to exploit in this supercycle. The outlook for the gaming market remains uncertain, with no immediate signs of improvement.