The dynamic world of DRAM supply is undergoing significant changes as one of the leading memory manufacturers predicts ongoing constraints continuing through 2028. This situation presents challenges for consumers, especially in the personal computing sector, as the demand for affordable PCs faces hurdles due to limited DRAM availability.

Predicted DRAM Supply Challenges Ahead

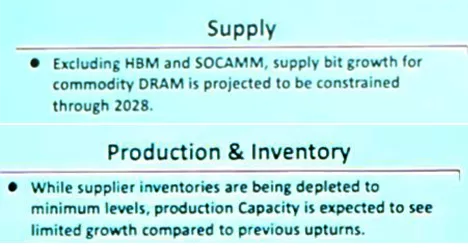

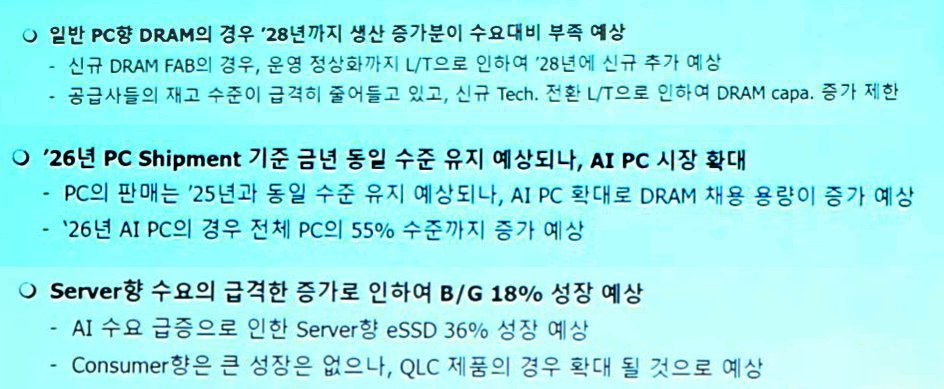

According to internal analysis from SK Hynix, the supply-demand imbalance in the mainstream PC market is expected to persist until at least 2028. Reports indicate that growth in “commodity” DRAM will remain limited, failing to meet the rising demand. Memory makers, including SK Hynix, have shifted their focus toward high-demand areas like AI servers, leaving the consumer market with little hope for increased production capacity.

Current reports suggest that supplier inventories have plummeted to historically low levels, intensifying allocation pressures. SK Hynix and other manufacturers are adopting conservative expansion strategies, aiming to maintain profitability rather than saturating the market with new DRAM supply. The demand for server DRAM is experiencing exponential growth, which is anticipated to accelerate further in the coming year.

Impact of AI and Server Demand on DRAM Market

The increasing prevalence of AI technologies is driving a surge in demand for AI training data centers among cloud providers. Estimates reveal that the server share of DRAM usage is expected to climb from 38% in 2025 to 53% by 2030. This surge points to a potential DRAM super-cycle, further exacerbated by reports of manufacturers booking production slots for 2026 ahead of time. This focus on AI and server markets means traditional PC DRAM production may not meet expected demand in the coming years.

Market Outlook for PC and NAND Memory

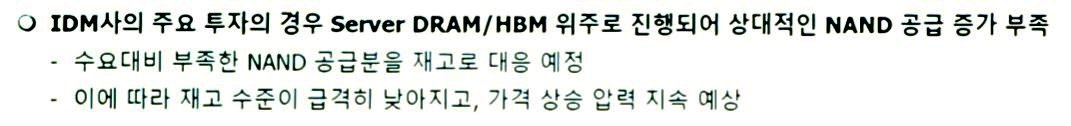

The AI PC market is poised for growth, projected to comprise approximately 55% of the total PC market by 2026. Despite these advances, overall PC shipments are anticipated to remain steady in 2025. SK Hynix’s analysis also highlights potential challenges in the NAND memory sector, where server-side demand, driven by higher profitability, could outpace supply for the consumer market.

Overall, these trends paint a concerning picture for consumers, as the expected resolution to the DRAM supply dilemma now appears further away, projected to last until the end of 2028.