The third quarter of 2025 has marked a notable upswing in CPU shipments, continuing a trend seen throughout the year. Uncommon factors have contributed to this growth, setting the stage for an intriguing period in the world of computing hardware.

Steady Climb in CPU Shipments

Recent data from John Peddie Research highlights a consistent rise in CPU shipments across both Client and Server segments. Reports suggest that the third quarter of 2025 experienced significant growth driven by the end-of-life of Windows 10, marking the third consecutive quarter of such trends. While the earlier growth in the year was spurred by tariff uncertainties, the recent surge is largely due to the transition requirements for Windows 11. This shift has prompted users to upgrade their systems, bolstering CPU sales, and benefiting OEMs with increased shipments that are projected to continue into the next quarter.

Although tariffs have impacted CPU sales, the compelling factor has been the upgrade necessity induced by Windows 11’s stringent hardware requirements, such as TPM 2.0 and Secure Boot. This necessity has driven many users to purchase newer CPUs, creating a ripple effect in the market.

We think the PC CPUs’ growth was prompted mostly by the end-of-life of Windows 10, and a little bit due to the tariffs,

The client PC market has now had three consecutive quarters of growth, which, except for Q3, is out of sync with traditional seasonality trends. We don’t expect Q4 to be very strong.

– JPR

A Close Look at Market Dynamics

Despite the positive momentum in Q3, expectations for Q4 remain cautious, with growth likely mirroring that of the third quarter. The 2.2% increase from Q2 is relatively modest compared to the 7.9% leap witnessed earlier due to tariff-induced uncertainties. This growth trajectory contrasts with the typically flat performance seen in the first two quarters of the year.

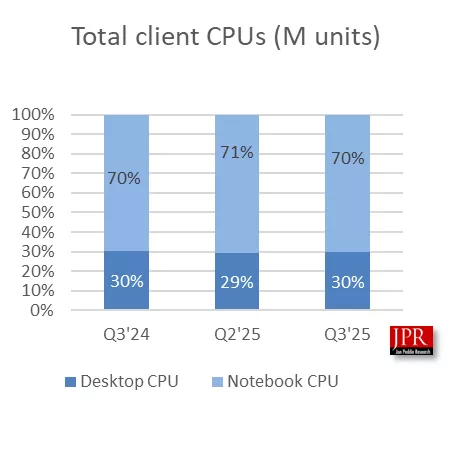

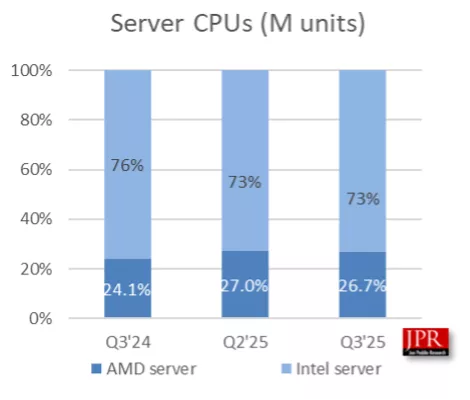

The CPU market’s dynamics saw Desktop and Laptop segments holding steady at 70% and 30% shares, respectively, with a slight fluctuation in laptop dominance during Q2. Meanwhile, server CPU shipments have mirrored client-side trends, growing 2.7% quarter-over-quarter and showing a robust 13.7% year-over-year increase. These developments underline the shifting landscape in CPU markets as users and manufacturers adapt to new technological demands.