TSMC is expanding its presence in the United States, but legal restrictions in Taiwan may prevent the production of the company’s most advanced chips on American soil. This struggle highlights the complexities of global semiconductor supply chains and the intricate balance of technological power between nations.

Challenges of Chip Technology Transfer

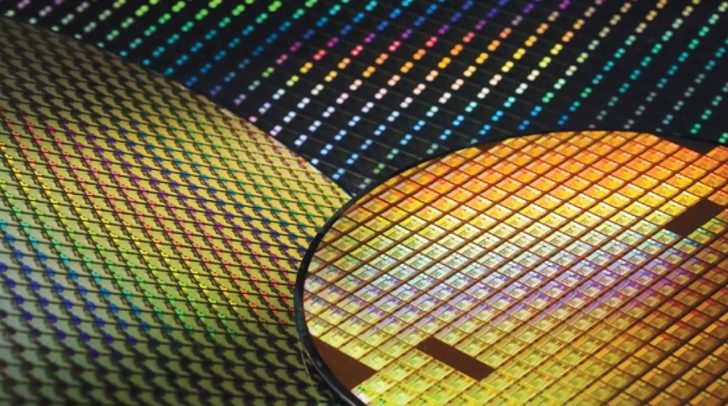

Taiwanese authorities have expressed concerns regarding TSMC’s increasing investments in the US, fearing this could lead to a significant technology transfer that might weaken Taiwan’s standing in the semiconductor market. According to reports, Taiwanese lawmakers questioned their government’s policy on TSMC’s overseas production, with Deputy Science Minister Fa-cheng Lin emphasizing Taiwan’s “N-2” policy. This policy ensures that the US will consistently remain two chip generations behind Taiwan. If TSMC develops 1.2nm or 1.4nm technologies domestically, it will only export 1.6nm technologies. The majority of TSMC’s R&D workforce is based in Taiwan, and the company adheres to the relevant regulations.

Geopolitical pressures are a significant factor in the push to bring TSMC’s operations to the US. The Trump administration, along with American chip manufacturers, has been advocating for this move to safeguard the chip supply chain. Despite the pressure and substantial interest from US clients, ensuring access to the latest chip technology remains a challenge, with plans to invest $300 billion in US facilities not changing this dynamic.

The Future of TSMC and Intel in the US

In Arizona, TSMC plans to expand by installing 3nm production lines, expected to be fully operational by 2027. By that time, Taiwan aims to be transitioning to A16 (1.6nm) technology following the anticipated success of the N2 (2nm) process. TSMC remains committed to Taiwan’s “N-2” policy, suggesting that the US must focus on developing its core technologies domestically. This endeavor will require significant resources in R&D, fabrication equipment, and talent to maintain a robust supply chain.

Analyst Dan Nystedt notes that TSMC’s hesitation to relocate high-end node production to the US could present a significant opportunity for Intel. Intel, which manufactures advanced chips domestically, may see increased interest in its 14A node technology. This shift could potentially reshape supply chain dynamics in favor of Intel Foundry. However, the full impact of these developments remains to be seen.