The challenges of chip production in the US are manifold, especially for industry giants like TSMC. Establishing manufacturing facilities in America leads to a noticeable reduction in profit margins, raising questions about the sustainability of such ventures. However, the shift in production holds a strategic significance that extends beyond immediate financial considerations.

Rising Costs and Strategic Investment

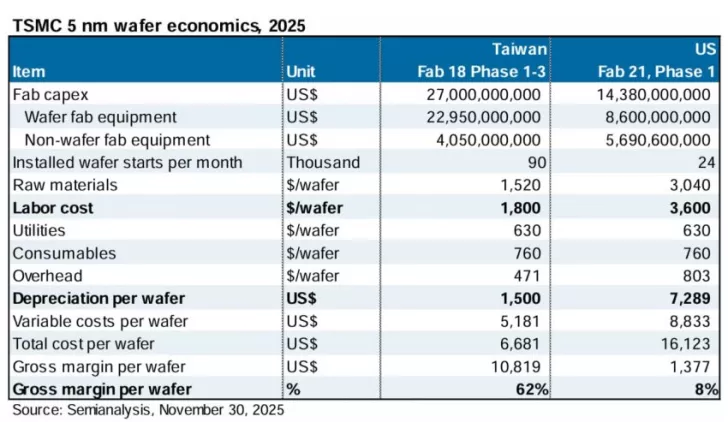

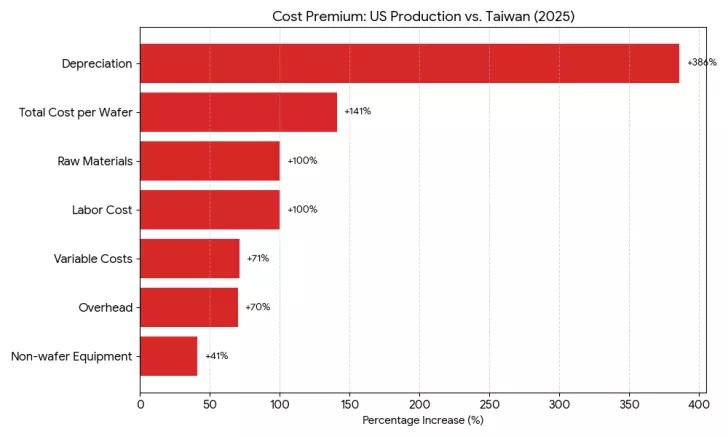

The emphasis on a “Made in USA” initiative, particularly within the semiconductor sector, has spurred companies like TSMC and Samsung to enhance their investments in the American supply chain. TSMC plans a massive $300 billion commitment to this cause, which includes a fab network in Arizona, as well as advanced packaging and R&D facilities. Despite the US venture incurring significant profit margin reductions, this shift is crucial for building a resilient supply chain. Reports suggest that operating these fabs in America comes at a high expense, with labor and depreciation costs per wafer being the primary factors impacting profitability.

Statistics reveal that the depreciation factor plays a significant role in the increased costs. For instance, if a US facility produces fewer wafers compared to a Taiwanese fab, each US wafer carries higher depreciation, contributing to the overall cost premium.

Labor Costs and Operational Culture

Beyond depreciation, labor costs pose another significant challenge. TSMC faces a decision: hire local American workers or bring in employees from Taiwan. The latter option often proves more cost-effective. However, the differences in work culture can impact operational efficiency. In Taiwan, quick responses to issues, even in the early hours, are part of the norm, as highlighted by TSMC’s Morris Chang.

If it breaks down at 1 in the morning, in the U.S. it will be fixed the next morning, but in Taiwan, it will be fixed at 2 a.m. If an engineer gets a call when he is asleep, he will wake up and start dressing… This is the work culture.

– TSMC’s Morris Chang

The company must ensure that gross margins remain a priority to sustain its US endeavors. This is particularly relevant given the recent reports of significant profit declines in the Arizona fab due to rising operational costs, which affect the long-term viability of non-Taiwanese manufacturing.

Geopolitical Considerations and Long-Term Vision

Despite these challenges, TSMC’s expansion into the US holds a broader objective: mitigating geopolitical risks that could impact its clientele. Companies like NVIDIA back TSMC’s strategic pivot towards the US, recognizing the importance of a diversified supply chain. Building a robust American supply chain might take years, but it is critical for TSMC, the world’s leading chip producer, to pursue this path with vigor.