The United States is currently experiencing a remarkable transformation in its semiconductor industry, as major players like TSMC and Samsung make significant investments. This influx of foreign capital marks a new era for the U.S. as it aims to become a leader in chip manufacturing.

America’s New Role in Semiconductor Manufacturing

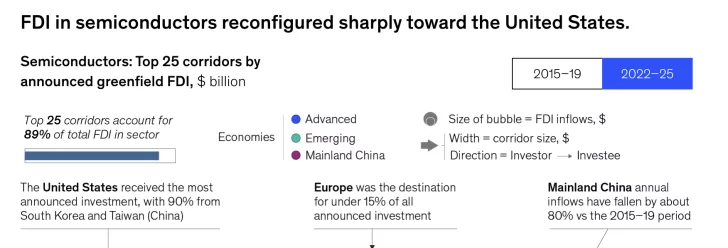

Under the Trump administration, there has been a marked increase in demand for semiconductors from U.S. companies. This demand has prompted industry giants like TSMC to commit massive investments to the country, ensuring a robust supply chain and positioning the U.S. as a key global player in semiconductor production. Projects such as the TSMC Arizona plant highlight the nation’s growing status as a semiconductor hub, rivaling regions like Taiwan. Reports suggest that the U.S. is leading in foreign direct investment in the chip industry, significantly outpacing other areas.

In 2025, nearly 90% of foreign direct investment in the chip sector was channeled to the U.S., with strong partnerships formed with Taiwanese and South Korean companies. TSMC leads the charge, both in the scale of its investments and its strategic goal of establishing a robust chip production network in the U.S. With its Arizona plant currently producing 4nm technology, TSMC plans to advance to the A16 (1.6nm) process, underscoring its commitment to the U.S. market.

South Korea’s Impact and the Trump Administration’s Influence

South Korean companies like Samsung and Micron have also significantly contributed to the U.S. semiconductor sector. Despite initial setbacks for Samsung’s Taylor facility, progress is back on track, with the plant preparing to produce the SF2 (2nm) process. Samsung’s involvement in the U.S. market is further emphasized by its orders for Tesla’s custom AI chips, reinforcing its pivotal role in the American chip supply chain.

The Trump administration’s policies have substantially boosted manufacturing activity in the U.S., treating chip production as a matter of national security. The former President even threatened hefty tariffs on companies like TSMC unless they established substantial manufacturing operations within the country. Given that a significant portion of TSMC’s customer base is in the U.S., maintaining reliable production lines domestically is crucial for the company.

Beyond the U.S., Europe is also making strategic moves to protect its technological base by implementing strict export controls and taking control of key entities like Nexperia. TSMC’s investments in Germany reflect a broader strategy to shift manufacturing from the East to the West. While these efforts do not guarantee complete independence for Western supply chains, they certainly enhance the region’s capacity to produce essential technologies locally.